Ripple XRP: A Centralized Cryptocurrency in A Very Decentralized Space

In the cryptoverse Bitcoin is automatically considered the king of the hill, which might be true but that doesn’t mean the king doesn’t have any contenders for the crypto throne. With the amount of different yet unique cryptocurrencies popping up, things might get a little ‘Game of Thrones’ like between all the cryptos. Speaking of intriguing cryptos, Ripple seems to pop out with its diversion from several crypto-norms, in the sense that, instead of avoiding banks like cryptos do, Ripple actually embraces them.

First things first, Ripple is a digital-payment processing system and a cryptocurrency, all at once. It is a distributed, real-time payment protocol for anything of value. It’s a shared public database, with a built-in distributed currency exchange, which operates as the world’s first universal translator for money. Ripple itself is currency agnostic and has a foreign exchange component built right into the protocol.

Ripple’s Foreign Exchange Component

Ripple itself acts as a pathfinding algorithm, which discovers the best route for a dollar to become a euro, etc. Ripple achieves this by taking a look at all the orders in the global order book and routes every transaction to the cheapest price available in the market. There is a transaction fee, however, that must be paid in Ripple’s cryptocurrency, the XRP.

The XRP

As already mentioned, Ripple is a cryptocurrency as well and goes by XRP. It is used to represent the transfer of value through the Ripple Network. The main purpose of XRP is to act as a mediator for other cryptocurrencies and fiat – exchanges, both.

The Ripple Net

RippleNet consists of a network of official payment-providers like banks and money services firms that use solutions that are developed specifically by Ripple to provide a frictionless, smooth experience for global transactions.

The Ripple Protocol Consensus Algorithm

Ripple doesn’t have a blockchain unlike its counterparts in the cryptoverse. Strange isn’t it? So how does it exactly carry out the verification of transactions and how does it look after everything to make sure everything is okay? This is where the Ripple protocol consensus algorithm (RPCA) comes in, which is Ripple’s patented technology.

The use of ‘consensus’ lends Ripple a bit of democratic air, as it means that if every node is in agreement with all the rest, there is no issue. Consider the nodes as a few chosen people who have the responsibility to make a joint agreement in order to carry out any decision. If they all agree on one thing like let’s say raising taxes, there will be no issue, however, if even one of them disagrees then nothing will materialize.

Benefits of Ripple

As a Low Commission Currency Exchange

This particular benefit comes in handy while dealing with the few currencies that can’t be directly converted into others, so, the banks have to turn to the US dollar that serves as a mediator. This means there is a double commission. Ripple, on the other hand, is a mediator too, and cheaper than USD, at that.

Fast Transactions

The average transaction time for Ripple is around 4 seconds as compared to Bitcoin’s hours or even more, and a number of days for the traditional banking systems. It’s safe to say that Ripple is lightning fast. Furthermore, Ripple is originally designed as an everyday payment system, so in addition to being time efficient, it is also much more power efficient than Bitcoin.

Banks Supporting Ripple

- Santander

- Axis Bank

- Yes Bank

- Westpac

- Union Credit

- NBAD

- UBS

Although both the Bitcoin and Ripple come under the large umbrella of “cryptocurrencies”, both their purposes couldn’t be further apart. Where Bitcoin was made in the hopes of creating a brand new financial system entirely. Ripple is helping with asset transfers and is seeking to assist the existing financial systems and upgrade their capabilities for worldwide transactions.

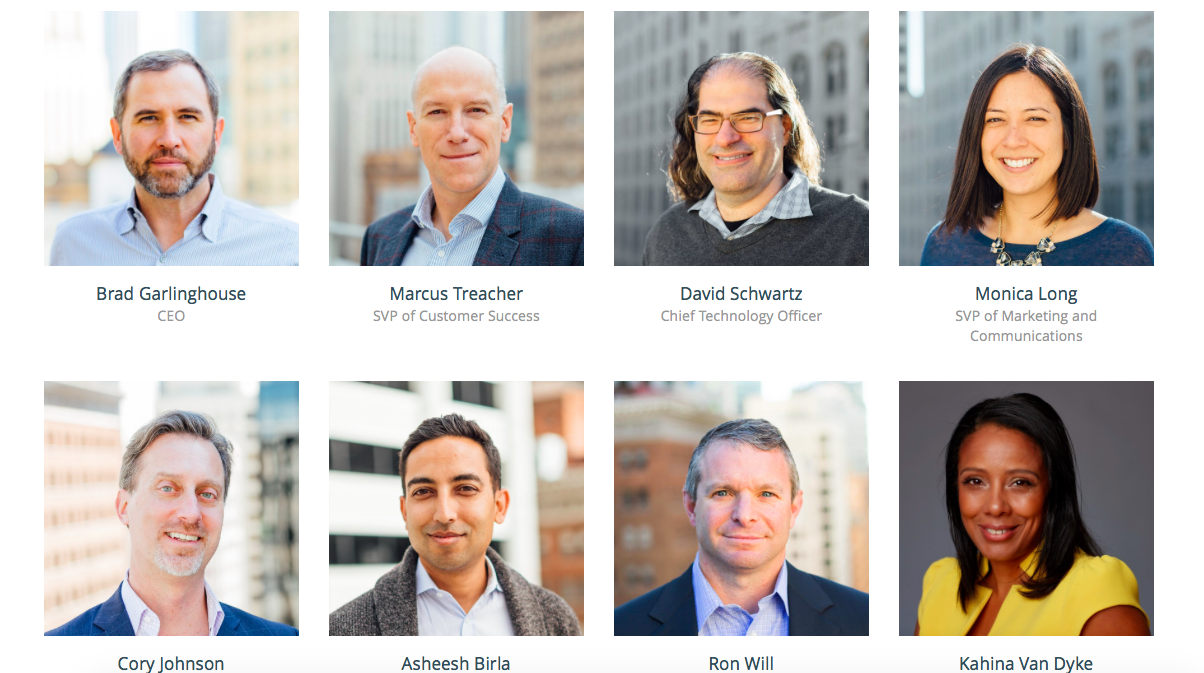

The Ripple Team

You can read Ripple’s consensus whitepaper here.