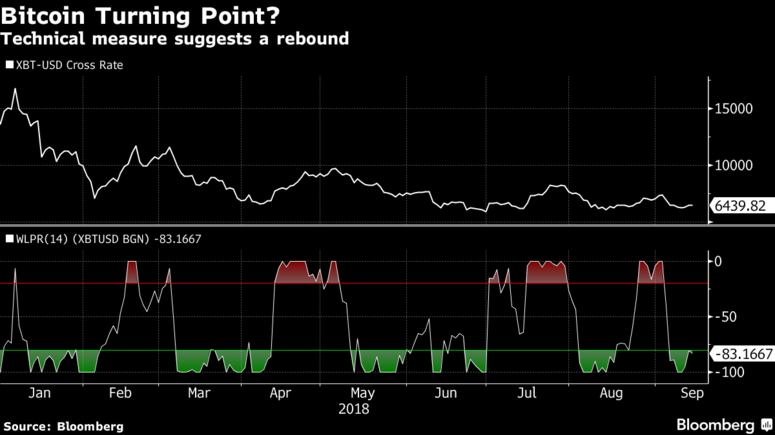

Cryptocurrencies, especially bitcoin, have seen a fall this year. They have been trading on low prices, relative to the highs experienced last year. But predictions by Micheal Novogratz and analysis of Williams Percent Range (Williams %R) Indicator suggest that after facing the low, Bitcoin will rebound.

Micheal Novogratz is one of the best known cryptocurrency investors. Recently, he marked a bottom in bitcoin. He further enlightened his observation on the low. He thinks that markets will retrace the breakout from now onward. He suggested that this year’s dropping value of the biggest cryptocurrency is going to end. He tweeted,

This is the BGCI chart…I think we put in a low yesterday. retouched the highs of late last year and the point of acceleration that led to the massive rally/bubble… markets like to retrace to the breakout..we retraced the whole of the bubble. #callingabottom pic.twitter.com/EasTBYgjSj

— Michael Novogratz (@novogratz) September 13, 2018

Apart from Micheal Novogratz, Williams %R indicator, developed by Larry Williams, has also worked out the same outcome and consequence that suggests Bitcoin rebound in future.

The Williams % R indicator moves between 0 and -100 and measures overbought and oversold levels. It is mostly applied to find entry and exit points of the market. At the moment, bitcoin is showing under -80 oversold. In past, when bitcoin went this low, it rose up by 22% i.e to $7,361 from $6,017. Similarly, it is expected to rise up again, following its historic trend. Therefore, the algorithm by Larry Williams is second to Micheal Novogratz’s idea of bitcoin rebounding.

Analysis by William %R indicator may have ended in agreeing bitcoin rebound but it is no secret that the indicator is prone to false signals. As it moves between overbought and oversold only, other analysis are required to determine more accurate market moves.

Many factors have caused crytpocurrencies to lose their value consequently. In this extreme low, bitcoin bouncing back is headlined at several occasions. However, bitcoin advocates are bullish on the future of bitcoin and expect it to be in their favor. Michael Ernest Doukas, attorney and counselor at Law, who also investigates economics, finance and cryptocurrency, justifies being bullish on bitcoin. But in long run, he suggests that institutional investors will determine the fate of bitcoin. Upon questioning if investors should be bullish, he told BlockPublisher:

It sounds like that is the recommendation, but over the long term as more institutional investors get on board. We’ll see.

So, what future truly holds for bitcoin can’t be guaranteed at this very moment and time will tell whether predictions of today are realities of tomorrow or not.